Apartment rent gains ease in Oklahoma, still outpace the nation

admin / September 2025

Outlook calls for rent growth to hold steady over the near term

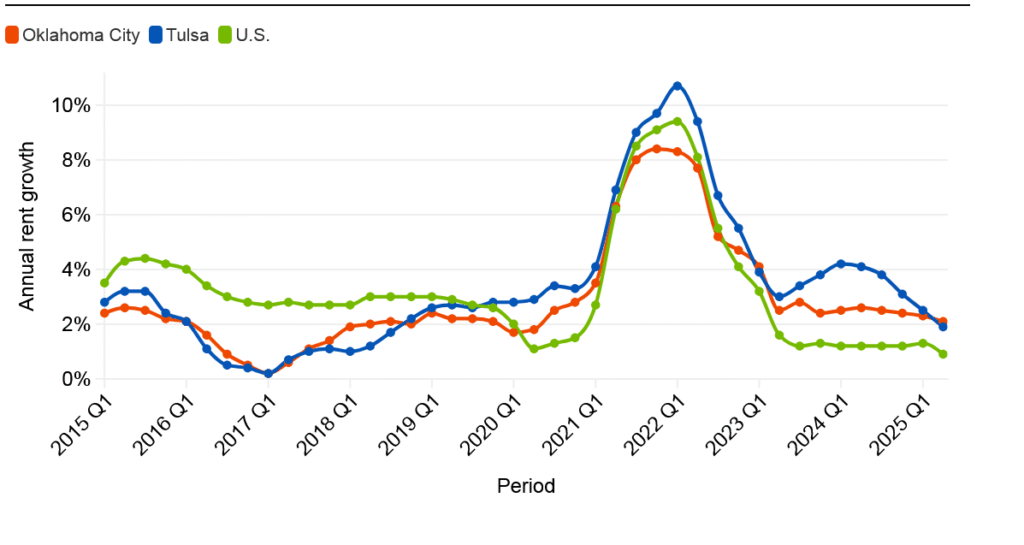

Apartment rents in Oklahoma have outpaced the US since 2022

While rent growth performances have eased in Oklahoma, they continue to outpace the U.S., at the same time that many Southern markets continue to navigate rent declines.

Through the second quarter, Oklahoma City reported 2.1% annual rent growth, while Tulsa registered growth of 1.9%, eclipsing the national performance of 0.9%. Rent gains have slowed the most in Tulsa, which was reporting an expansion of 4% until last year.

Still, rent gains in the state are more akin to Midwest and West Coast markets, which have emerged as national leaders. Both markets rank similarly to others such as Boston, Kansas City and Orange County, California.

Annual changes in rents across Oklahoma have fluctuated in previous cycles, particularly during the 2016 energy downturn, as demand dried up in the wake of heavier supply. As a result, the state underperformed the U.S. over the previous expansion. Even so, Oklahoma markets remain relatively affordable, and economic diversification into manufacturing, aerospace and high-paying industries is driving in-migration post-2020. This trend supports steady housing demand in the long run.

Rent gains in Oklahoma City edged its smaller peer in the past year for the first time since 2023. Across submarkets, Moore has emerged as a rent growth leader over the past year. Meanwhile, areas with more affordable rent levels, including Central Oklahoma City and Midwest City/Del City, outperform with annual rent gains of 2% or greater. Meanwhile, downtown Oklahoma City and South Oklahoma City report modest gains of near 1% or lower.

Tracing a similar tenor, Tulsa is led by relatively affordable areas. For example, Midtown reported annual gains of 5% in the past year, followed by East Tulsa and Riverside/Peoria. At the same time, downtown is the lone rent submarket with rent losses in the past year with added supply side pressure in the urban core.

The outlook calls for rent growth to hold around current performances over the next 12 months before rising closer to 3%, given both Oklahoma City and Tulsa are relatively well balanced in terms of supply and demand. Construction levels have fallen to near 15-year lows in both markets, and demand is poised to hold firm. Still, risks prevail, including a labor market that continues to soften, which could dampen household formation and demand for multifamily housing.

« Previous