Have Multifamily Rents in Oklahoma Turned a Corner?

admin / November 2023

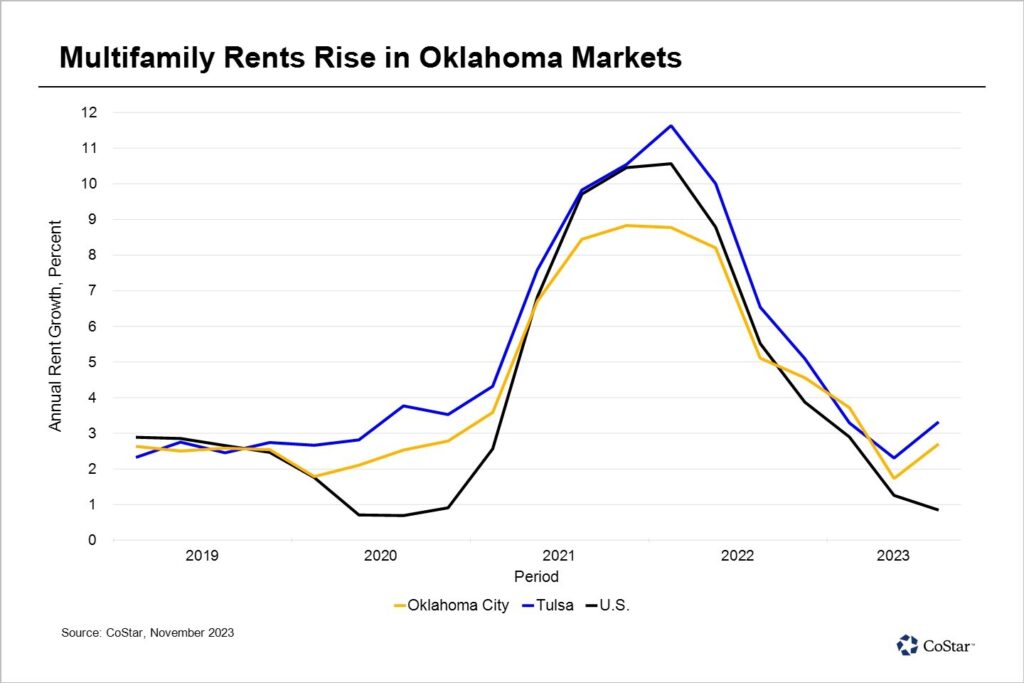

Third Quarter Results Reveal Potential Inflection Point in Oklahoma City and Tulsa

After several quarters of declining rent growth, apartment rents bounced back in Oklahoma City and Tulsa through the third quarter even as the broader national rent trend continued to decline. Through the end of the third quarter, Oklahoma City reported an average annual rent growth of 3.4% while Tulsa reported growth of 3.4%, above results from the prior quarter.

Within the Oklahoma City multifamily sector, most neighborhoods reported elevated demand and higher rents across the market. Norman and central Oklahoma City led the market with average rent growth above 3.5%. Even downtown Oklahoma City, which carries a $450-a-month premium above the market average, posted an average rent growth of 3%. The lone laggard, northeast Oklahoma City, reported a decline in average rent growth of 3.1%.

All neighborhoods within Tulsa’s multifamily sector continue to report stable rent growth. Riverside, Peoria and Midtown posted average increases ranging from 4.5% to 6%. Leading demand in Tulsa, the Broken Arrow area reports growth close to 2.9%, while rent growth in downtown Tulsa ranked among the lowest increases at 1.5%.

The construction pipeline in Oklahoma City and Tulsa has increased over the past 18 months but remains relatively manageable. Both markets report mid-3% from the perspective of units under construction as a share of their total inventory, below the national construction average of 5%. Construction is expected to roll over further as elevated interest rates present greater barriers to construction starts.

As demand for rental apartments has returned, the average vacancy has declined and now falls within the range of pre-pandemic averages. Oklahoma City reported an average vacancy rate of 10.5% for apartments, while Tulsa is near 8.4%. The outlook for both markets shows the average vacancy continuing to flatten with little threat from new supply.

Apartment rent growth is poised to rise as demand continues to stabilize and the development pipeline slows. Year to date, demand in Oklahoma City and Tulsa is around 500 units and 200 units, respectively. Those levels are behind past performances, but a stark improvement from the underperformance in 2022. As a result, rent growth is expected to increase above 4% through the end of 2024 and into 2025.

« Previous Next »