Oklahoma City Sales Volume Softens Amid Rising Interest Rates

admin / August 2023

Retail and Multifamily Segments Drive Investment

By Bill Kitchens

CoStar Analytics

August 22, 2023 | 11:39 AM

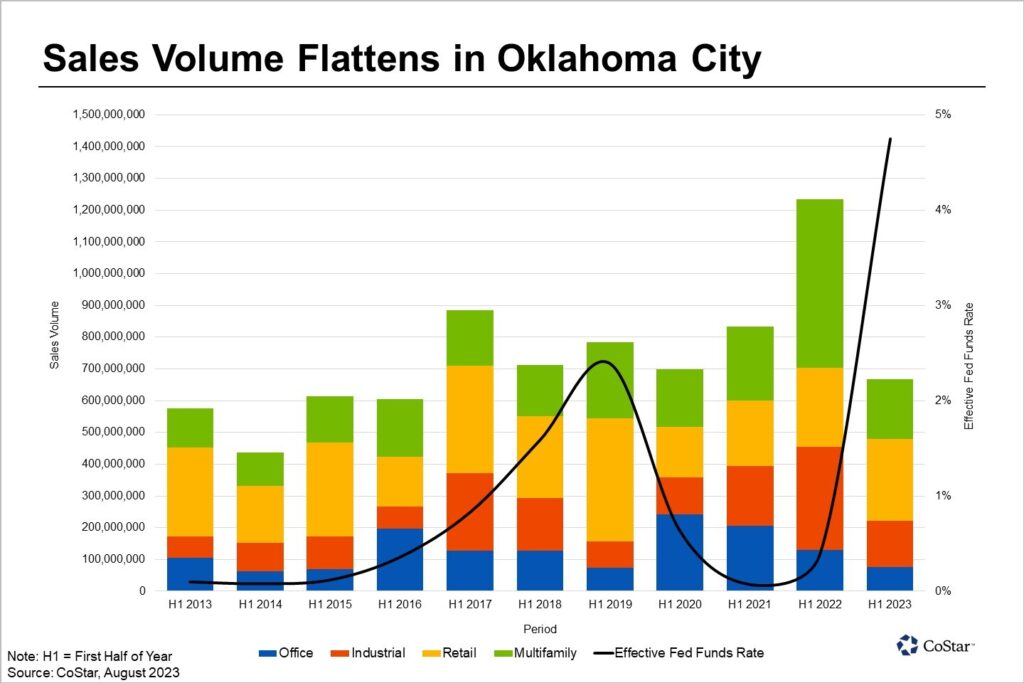

Oklahoma City is reporting a slower first half of 2023, with $666 million in sales volume. That is down from 2022 when transaction volume peaked at $1.2 billion. Deal volume is declining due to rising interest rates, pushing the cost of debt higher and creating a bid-ask spread between buyers and sellers.

Investors seeking retail properties lift overall sales volume with an estimated $257 million in retail properties traded in the year’s first half. Volume was up 3% from the same period last year, and the number of transactions was up 9%. Portfolio deals aided sales volume for retail properties. For example, Realty Income Corporation acquired a Dick’s Sporting Goods location at the Shops at Quail Spring as part of a broader 83-property portfolio deal with CIM Group, spanning several markets in the South and Midwest.

Multifamily properties continue to drive overall sales, logging $187 million in the first half of the year, down 65% from the same time last year. The Northwest and South areas in the market drove sales volume, accounting for a combined 57% of units traded in the first half of the year. In one of the largest deals this year, Weidner Apartment Homes purchased the Sycamore Farms Apartments from Vesta Capital for $59 million, or about $148,000 per unit. Vesta Capital acquired the property in February 2020 for $44 million, or about $110,550 per unit, yielding $15 million over a three-year hold period.

Investors acquired $147 million in industrial properties in the first two quarters this year, down 55% year over year. One market-mover was electric vehicle manufacturer Canoo purchasing the roughly 635,000-square-foot building along Interstate 40. The company selected Oklahoma City for its manufacturing operations with plans to add as many as 550 jobs to the area. Terex previously occupied the building, which moved its operations to Mexico. Canoo selecting Oklahoma City is part of a broader economic development effort for the city to diversify in industries beyond energy.

Office investment reported the lowest sales volume with $75.6 million, down 42% from the same time last year and the slowest first half since 2019. Among the most significant deals involved the Heartland Payment headquarters, where Syndicated Equities purchased the building from Real Capital Solutions for $47 million. The roughly 111,000-square-foot building was completed in 2020, and Heartland Payments occupies the building on a net-lease basis. While the office market continues to find its footing, vacancy rate expansion in Oklahoma City has been relatively tame compared to the U.S. average.

« Previous Next »