Industrial Construction Ticks Higher in Oklahoma City

admin / March 2024

Hobby Lobby Doubles Down on “Thunder Town”

Through early 2024, there are 3.9 million square feet of industrial space under construction in Oklahoma City, and most of the activity is driven by Hobby Lobby, a locally headquartered company that maintains a massive distribution network across the metropolitan area

Its new 3.6 million-square-foot distribution center in the Southwest industrial node is just one of over a dozen sites operated by the company in Oklahoma City and will be one of the last major new sites added to the market for the foreseeable future.

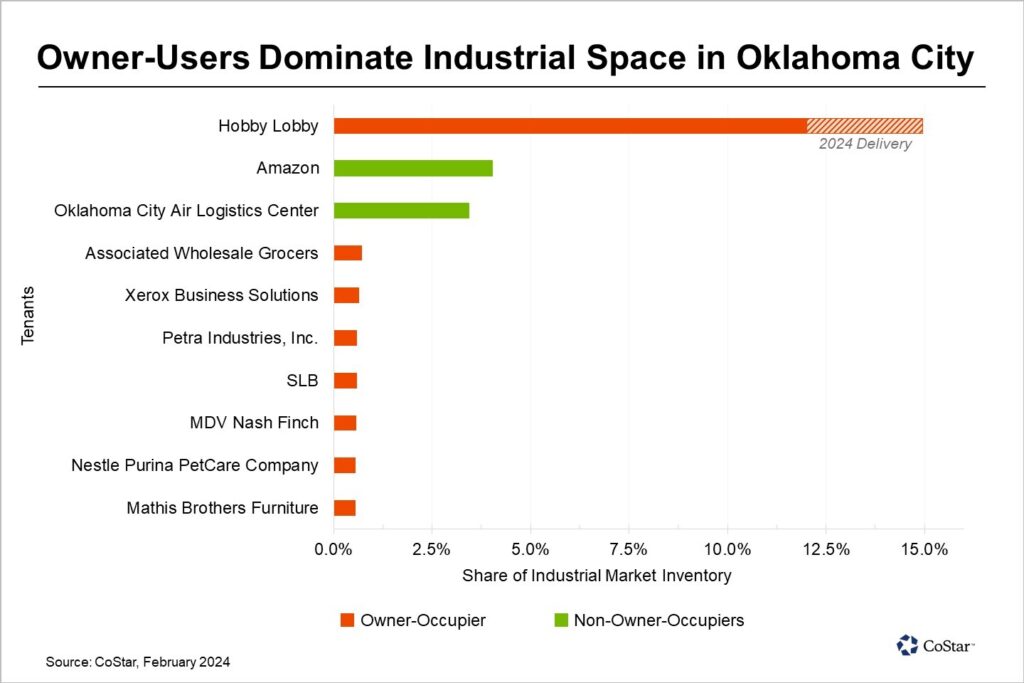

Oklahoma City’s industrial market is heavily influenced by owner-occupiers, led by Hobby Lobby. This is in contrast to many other peer markets across the southern U.S., where developers have added an abundance of speculative logistics buildings, leaving some markets overbuilt.

In contrast, Oklahoma City’s largest players tend to prefer build-to-suit projects. Hobby Lobby, in particular, controls 12% of the overall market, a larger proportion than the next four largest tenants combined. This share is only expected to grow at the start of the year when its new building is completed, and its new share rises to 15% of all industrial space in Oklahoma City.

The Southwest industrial node has been the focus of most development for the past few years, where builders have grown existing inventory by over 40% in the past decade. Most activity was centered on the construction of these big-bay industrial buildings and around the Will Rogers World Airport. The area also boasts excellent highway access with ties to interstates 40 and 35 that connect Oklahoma City to other cities across the South and beyond.

The construction landscape in Oklahoma City is not immune to the headwinds facing the national economy. High interest rates and borrowing costs have dramatically reduced construction starts, with just 595,000 square feet breaking ground in 2023, the lowest level in over a decade. The market may face a dearth of available space as demand is expected to pick up under more favorable economic conditions when vacancies are expected to tighten again. The market reports current vacancies of 5%; they are anticipated to compress to around 4% through the near term.

« Previous Next »