Office Demand in Oklahoma Marked by Shrinking Deal Sizes

admin / March 2024

Vacancy Rates Expand Modestly Compared to US Average

By Bill Kitchens

CoStar Analytics

February 15, 2024 | 3:37 P.M.

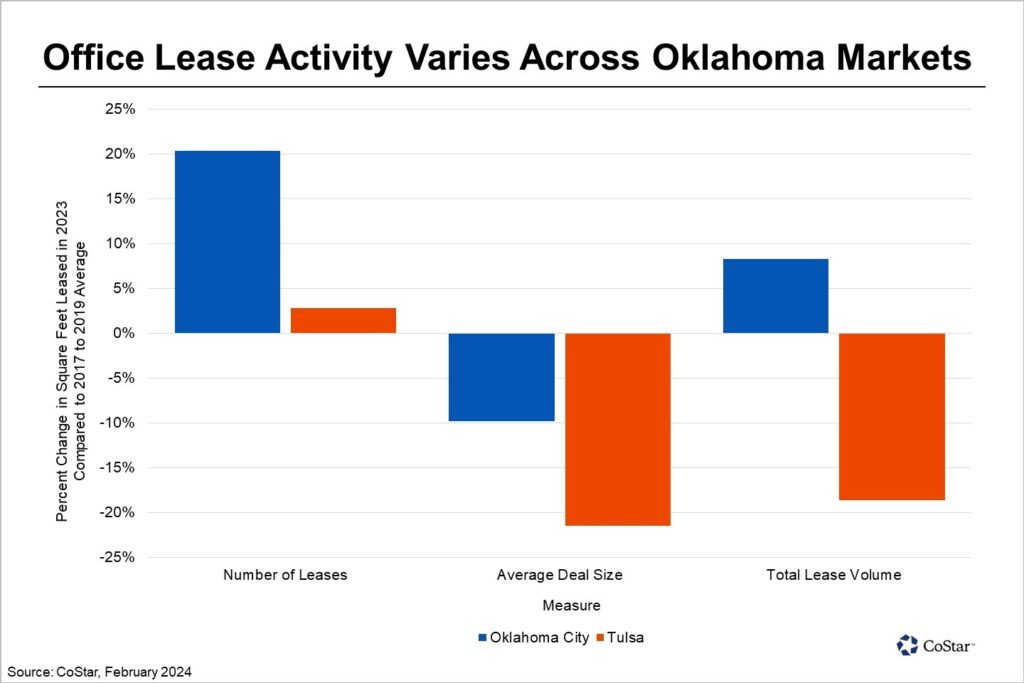

The common denominator for office demand in Oklahoma’s major markets is shrinking lease size for new deals. Like most markets, smaller leases in Oklahoma City and Tulsa reflect tenants’ refocus on spatial efficiency for their work forces. Even so, overall lease volume and number of leases captured varies in each market.

Tenants committed to 1.9 million square feet in new leases in Oklahoma City during 2023, up 8% compared to averages reported from 2017 to 2019. Rising leasing activity over the past three years bucks the national picture, where the overall square feet leased has slipped. New leases are 8% smaller in 2023 compared to the average deal size reported from 2017 to 2019. Even so, office brokers remain busy with the number of leases captured in Oklahoma City up 20% compared to pre-pandemic norms.

Leasing activity was spread across several areas, led by the office centers in northwest and downtown Oklahoma City, accounting for about 60% of the square footage leased last year.

Some of the largest leases involve human resources technology and insurance companies. Expanding its presence in Oklahoma City, Paycom penned a 168,000-square-foot lease at the 7725 Connect building. The three-star, 780,000-square-foot building was completed in 1963 and is 90% leased.

Leasing activity in Tulsa fell 19% in 2023 relative to levels from 2017 to 2019, registering about 1.1 million square feet. The number of lease deals is marginally higher at 3% compared to the same pre-pandemic time frame.

The average deal size fell more dramatically compared to Oklahoma City, down 21%, coming in at 2,160 square feet in 2023. Leasing was concentrated in the south-central, downtown and mid-town office nodes, capturing about 81% of all lease volume. For example, JP Morgan committed to 9,370 square feet at the recently completed Santa Fe Square downtown. The property was completed last year and is essentially full with Vital Energy and Hall Estill law firm also taking space.

At 10.2% in Oklahoma City and 11% in Tulsa, vacancies have drifted higher by an average of 122 basis points since the beginning of 2020. That is below the U.S. norm, where vacancies have risen 420 basis points with a vacancy rate of 13.7%. Vacancies in Oklahoma are expected to expand further but remain below the U.S. average.

« Previous Next »