Oklahoma City Maintains Apartment Demand Momentum

admin / March 2024

Vacancy Expansion Slows Over the Past Year

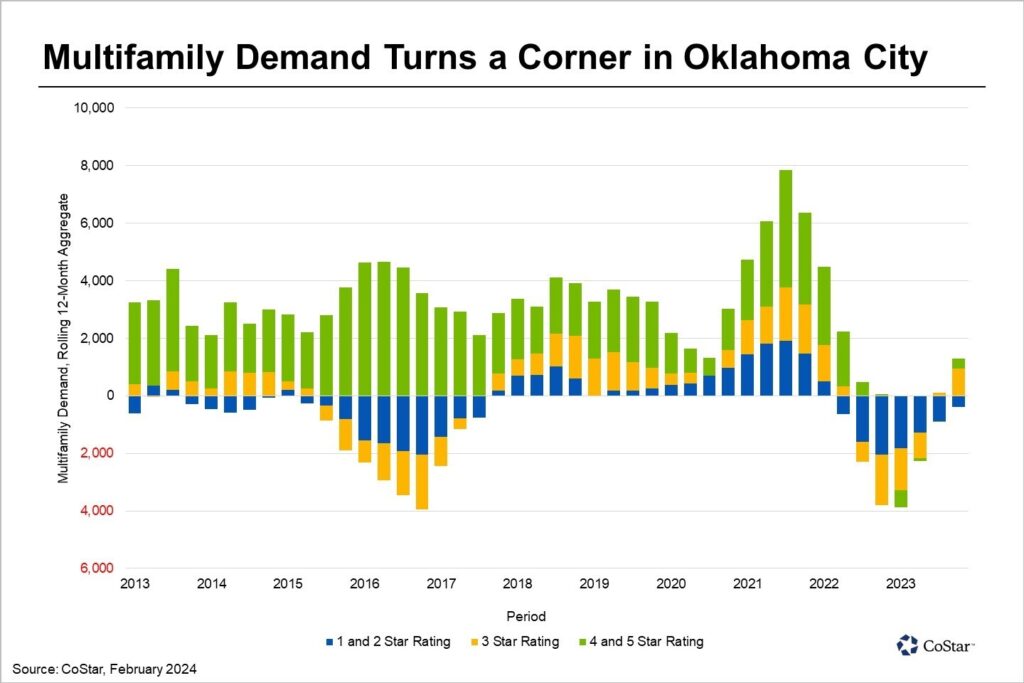

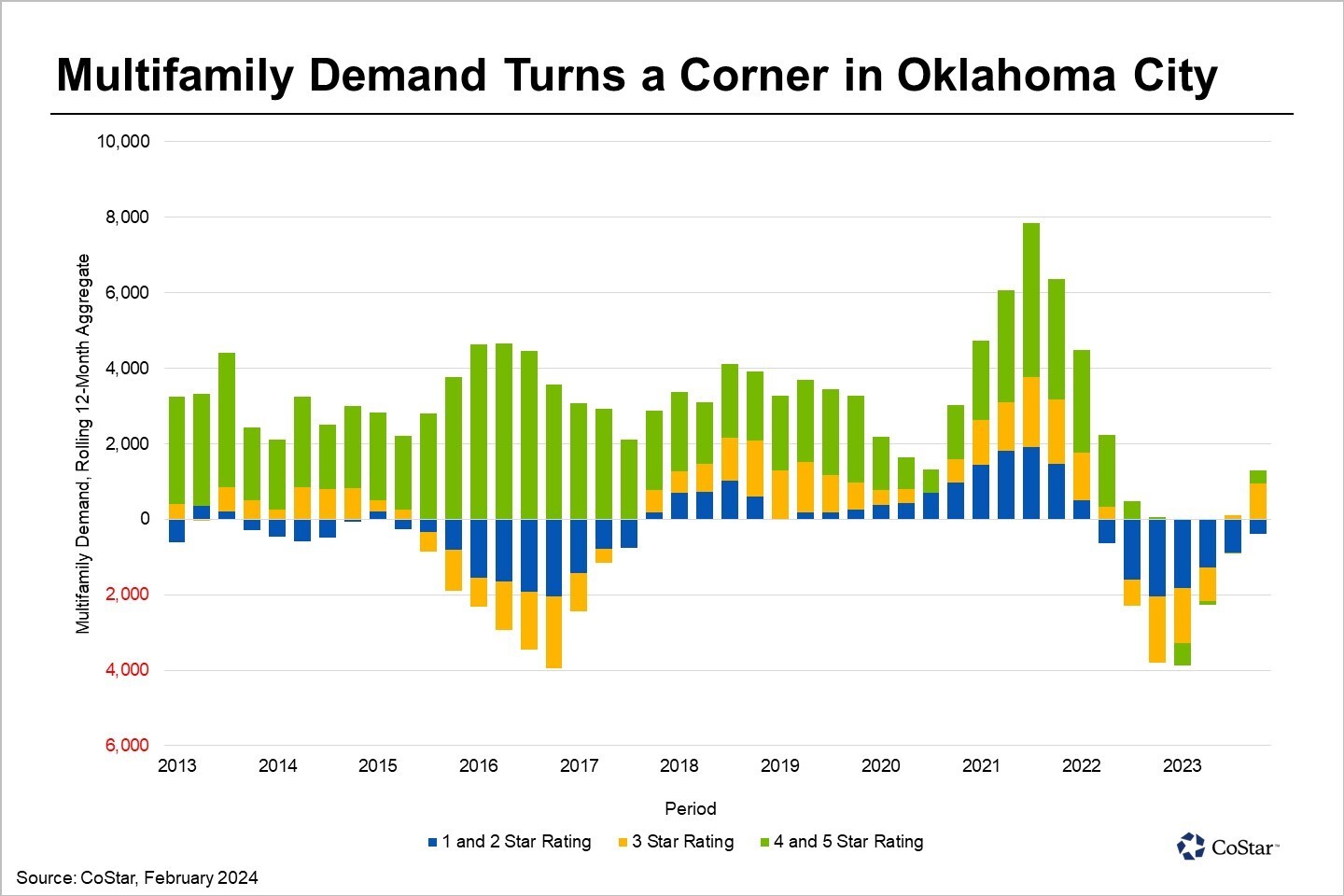

After two years of under-performing demand, renters filled a net increase of 430 units in Oklahoma City last year. Most demand for rental units occurred within the more affordable three-star segment, followed by higher-quality and pricier four- and five-star-rated properties.

In turn, the pace of vacancy rate expansion has slowed, which is allowing the market to re-balance. As of mid-February, the vacancy rate sits at 11%, just above the decade average of 10%.

Mid-tier and lower-rated apartments report improving demand in Oklahoma City. Renters filled 273 units in properties identified as three-star and lower in 2023, an improvement from the nearly 1,900 units vacated in 2022. Vacancies in this segment remain elevated, averaging nearly 12%, up from the recent trough of 7.7% in 2021 and above the 10-year average of 10.3%. Oklahoma City’s apartment inventory skews higher toward mid- and lower-tier properties, with about 78% of units identified as three-star and lower.

Elevated vacancies in the lower end of the quality spectrum are evidence of the residual economic stress many mid- to lower-income households face. Market participants continue to cite maintaining and growing occupancy as one of the major focuses for owners and leasing professionals.

Meanwhile, the four- and five-star segment reported demand for 150 units in 2023, with that momentum continuing this year. While demand levels slipped in 2022, they did not turn negative. As a result, the vacancy rate holds steady at 8.8%, below the market average.

In terms of geography, the northwest quadrant of the city continues to capture more demand, thanks to demographic tailwinds found in this corner of the city, including higher-incomes and proximity employment centers.

Downtown Oklahoma City also reports improving demand over the past year on account of more residential options. Canadian County was another out-performer, tracing rapid population growth to the west of the market. Other areas are still under pressure, including neighborhoods to the south and central Oklahoma City.

The forecast expects Oklahoma City’s vacancy rate to hold relatively firm at by the end of 2024, before contracting below 10% in 2025 and beyond. That forecast is supported by moderate construction activity and re-balancing demand.

« Previous Next »