Looking for a Trend in One Month of Inflation Data

admin / August 2022

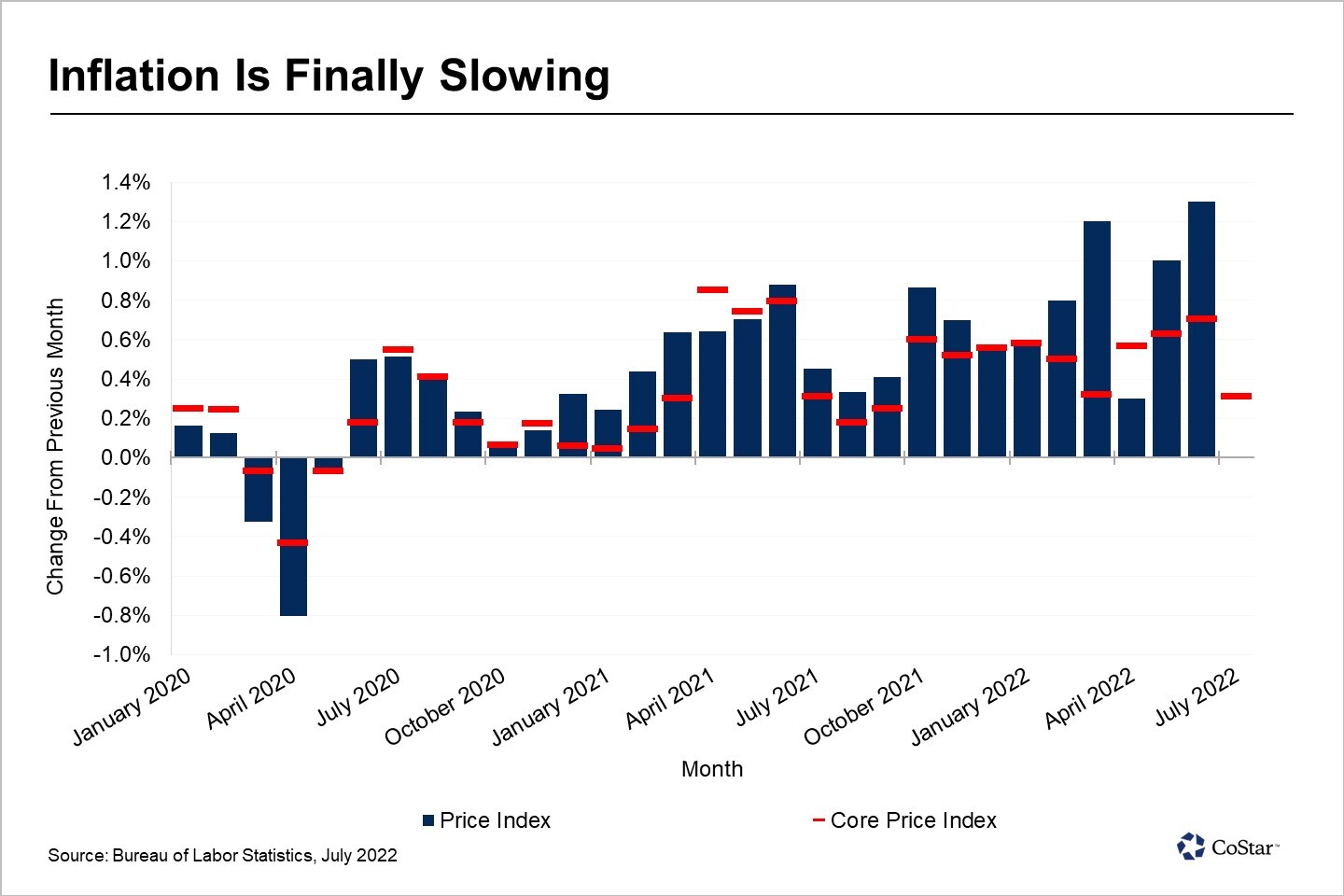

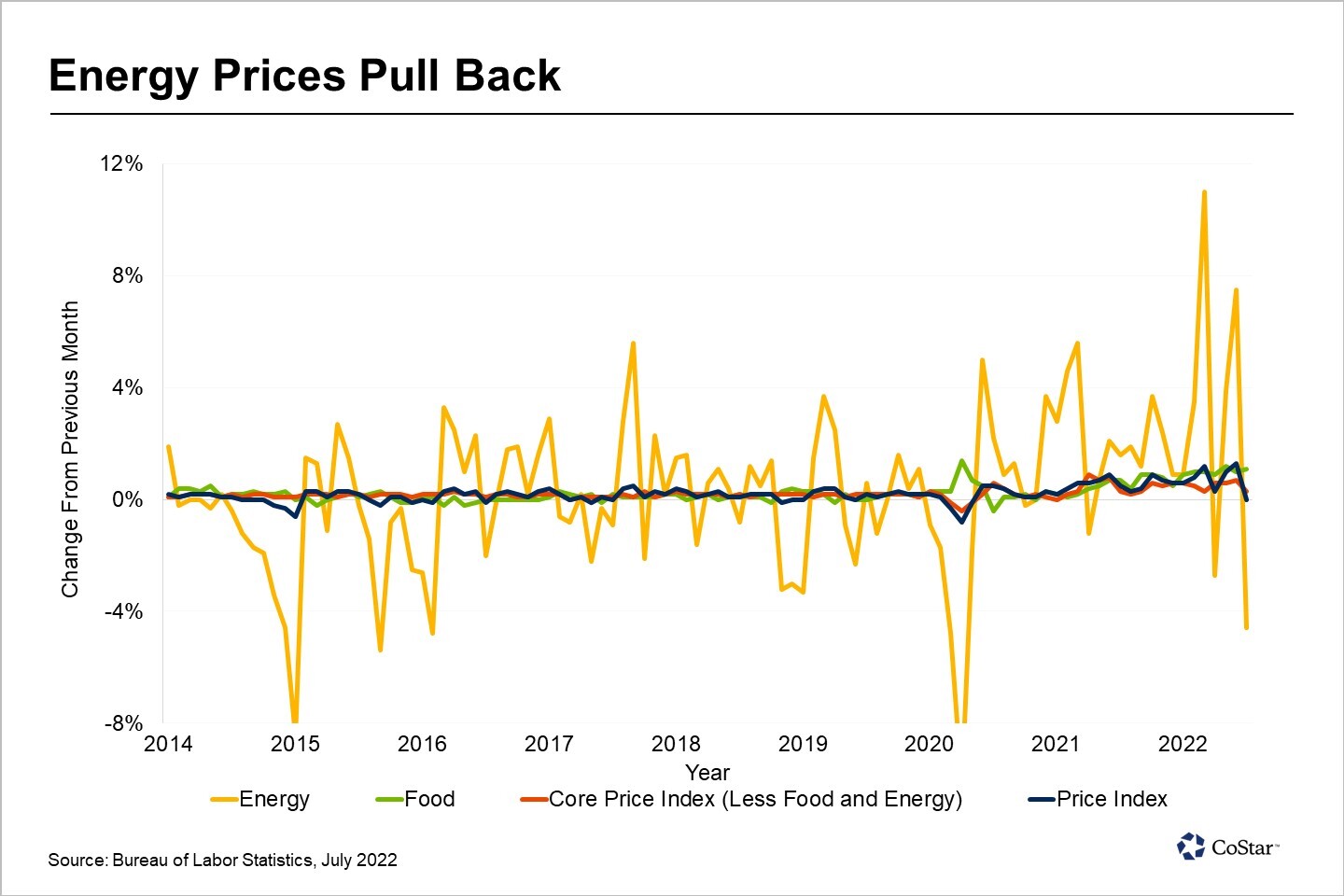

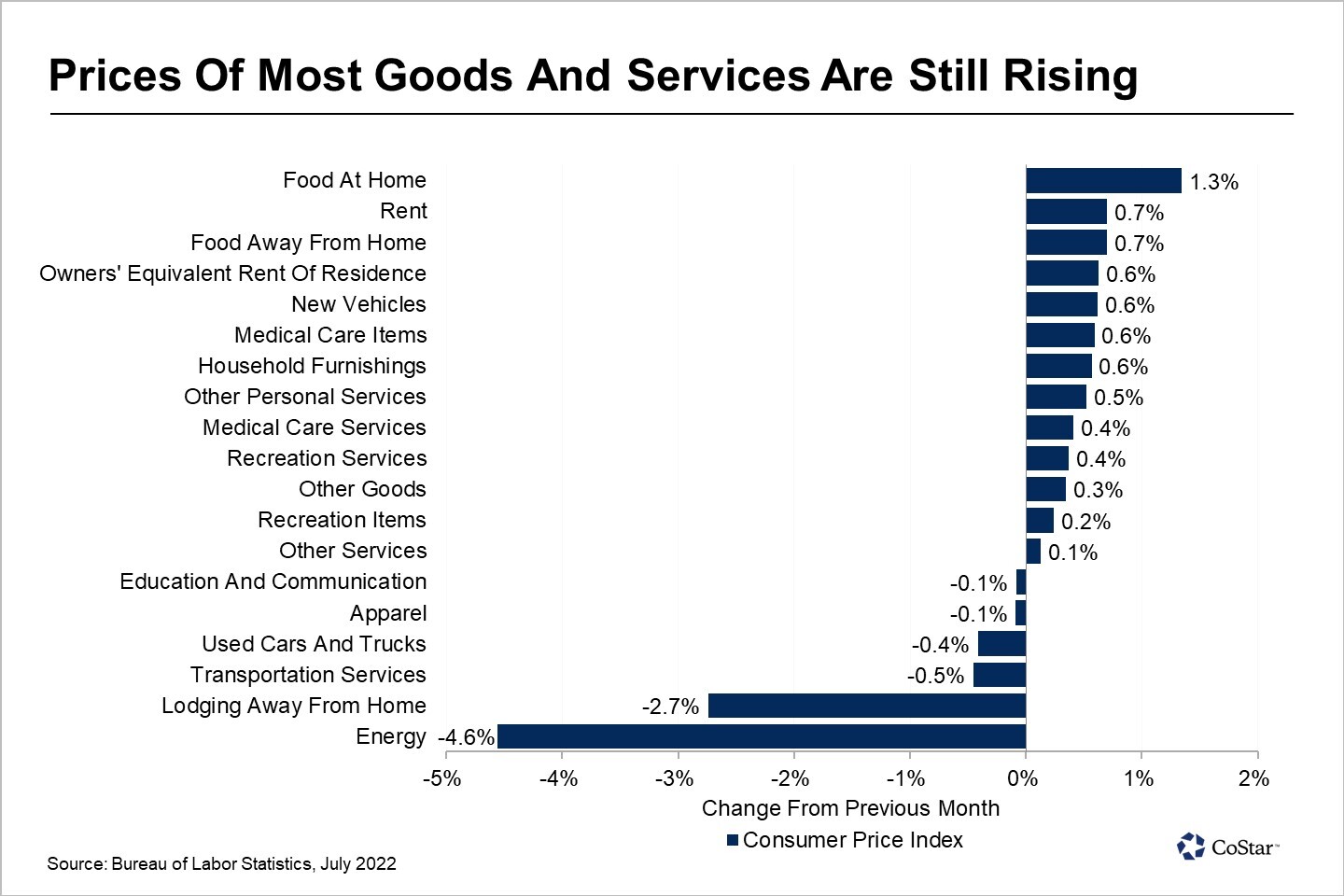

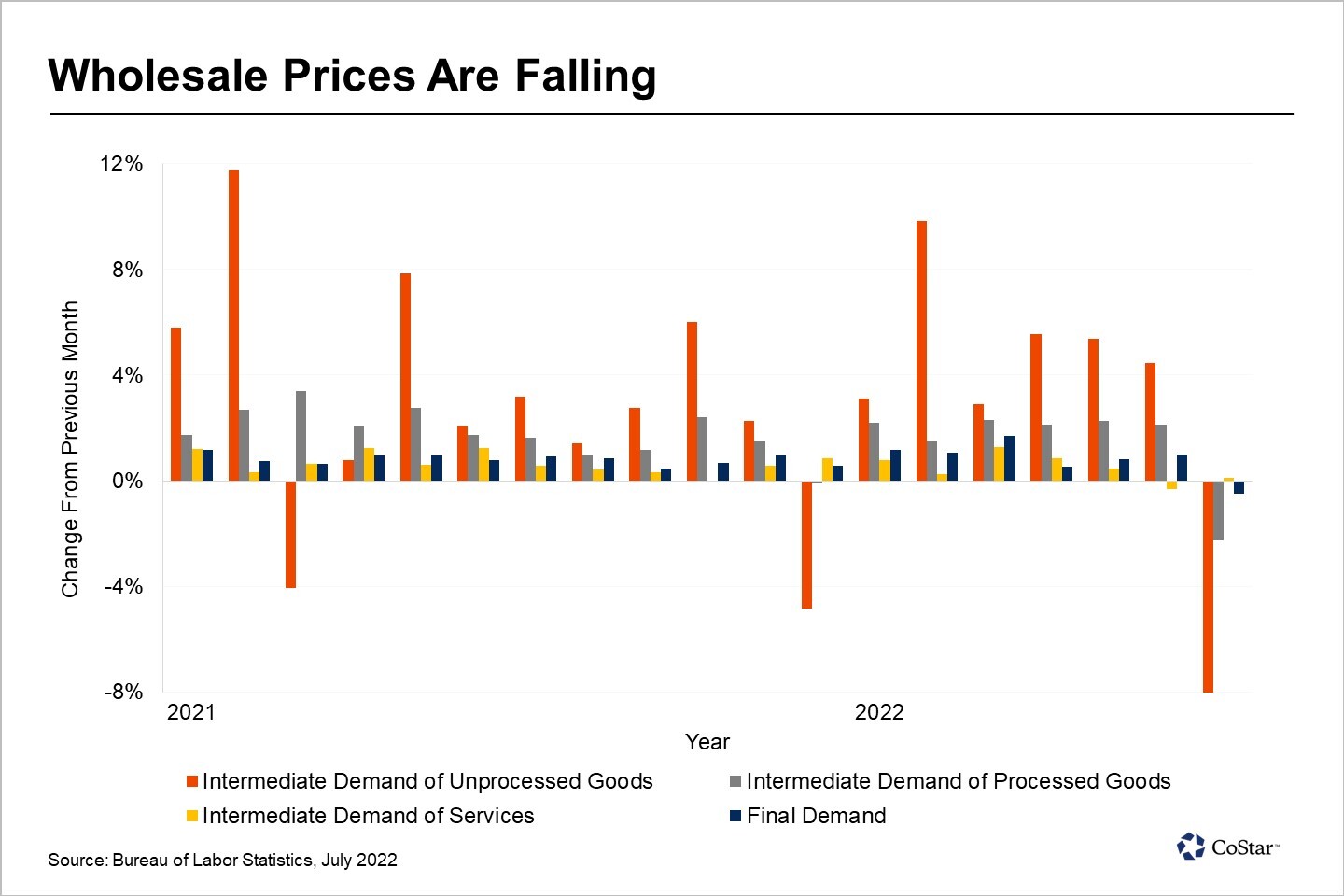

A broad sweep of inflation indicators eased last week, showing a range of prices decelerating in July.Primarily, the Bureau of Labor Statistics’ reading of consumer prices came in flat for the month, with year-over-year growth falling from 9.1% to 8.5%. Producer prices for final demand, which represent what businesses have to pay for the goods and materials they use in production, fell by 0.5% in July, while import and export prices fell by 1.4% and 3.3%, respectively. Many might be wondering — was this just one month of moderating price growth or have we seen inflation peak? Let’s not get too excited. After all, we had a similar experience earlier in the year when it appeared that inflation had peaked after three months of strong gains. After consumer prices grew by 1.2% in March, growth in April slowed to just 0.3% — then the slowest rate in eight months. At the time, the war in Europe had just begun to impact energy prices, which grew by 11% in March. But these saw a modest reset in April when consumer energy prices fell by 2.7%. Equities were also in the midst of a bear market, lowering disposable income and consumer spending, contributing to slower price growth in April.Energy costs bounced back in the following two months but have recently started to moderate again. Consumer energy prices fell by 4.6% in July, the primary reason why the consumer price index was flat on a month-to-month basis. Yet there is good reason to be skeptical that inflation has peaked as energy prices can rapidly bounce back.  Moreover, prices in other categories continue to grow at worrying rates. Prices for food at home and food away from home experienced outsize gains in July, growing by 1.3% and 0.7%, respectively. These account for about 13.5% of the price index, compared to energy’s 9.2% weight. While perhaps less important to the “Has inflation peaked?” debate, escalating costs of food at home are especially concerning for low-income families who allocate a larger portion of their budgets for these items.Rents grew by 0.7% percent in July and owners’ equivalent rent of residences grew by 0.6%, whereas the range in month-to-month gains under a normal rate of inflation would lie between 0.2% and 0.3%. The rate of increase in these two housing measures in the CPI have lagged actual apartment rent growth and home price increases for several years, mainly because the index is composed of housing costs paid by all tenants and homeowners, not just those who are leasing or buying at today’s market prices. For example, longtime homeowners may not have faced increasing housing costs, other than utilities and other expenses, as their mortgages are typically locked in for years. Similarly, apartment dwellers sign yearly leases with rents fixed during the lease term.On average, then, the price index averages out the more recent rising costs of housing with the lower costs of long-term tenancy. However, even as apartment rents and home price appreciation have started to cool from meteoric highs during the pandemic, many renters and home buyers could face higher housing costs in the coming months as they enter into new lease agreements and home purchase contracts. As a result, we expect to see the housing cost component of the CPI to continue to trend higher.  While energy prices are quite volatile, their impact on the production of final goods can take months to materialize because of the many steps in the production chain. For example, lower energy costs are likely to be felt first in the prices of unprocessed intermediate goods, where prices fell by 12.4% in July. But, as some evidence that inflation has peaked, wholesale prices fell throughout the production chain in July. Prices for processed intermediate goods fell by 2.3% and prices of goods for final demand fell by 0.5%. While energy prices are quite volatile, their impact on the production of final goods can take months to materialize because of the many steps in the production chain. For example, lower energy costs are likely to be felt first in the prices of unprocessed intermediate goods, where prices fell by 12.4% in July. But, as some evidence that inflation has peaked, wholesale prices fell throughout the production chain in July. Prices for processed intermediate goods fell by 2.3% and prices of goods for final demand fell by 0.5%. Aside from the price indices showing easing inflation, households’ expectations of the future path of inflation have rapidly improved. The median consumer expectation for inflation a year from now fell from 6.8% in June to 6.2% in July, the steepest decline in the series’ history. Households also feel better about the longer-term future. The median expectation for inflation three years ahead also continued to decline and is nearly at its pre-pandemic range. Aside from the price indices showing easing inflation, households’ expectations of the future path of inflation have rapidly improved. The median consumer expectation for inflation a year from now fell from 6.8% in June to 6.2% in July, the steepest decline in the series’ history. Households also feel better about the longer-term future. The median expectation for inflation three years ahead also continued to decline and is nearly at its pre-pandemic range. What We’re Watching …Regardless of whether we’ve achieved peak inflation this go-around, it will take some time for price increases to slow down to what we consider more reasonable rates. Oxford Economics sees inflation persisting near these high rates through the end of the year before slowing meaningfully in 2023, so let’s not celebrate just yet. If that’s the case, the Federal Reserve will likely stay the course with its aggressive tightening plans. We’ll probably hear more of that when they meet at the annual Jackson Hole policy symposium later this month. What We’re Watching …Regardless of whether we’ve achieved peak inflation this go-around, it will take some time for price increases to slow down to what we consider more reasonable rates. Oxford Economics sees inflation persisting near these high rates through the end of the year before slowing meaningfully in 2023, so let’s not celebrate just yet. If that’s the case, the Federal Reserve will likely stay the course with its aggressive tightening plans. We’ll probably hear more of that when they meet at the annual Jackson Hole policy symposium later this month. |

« Previous Next »